Power REIT (PW) is a real estate investment trust (REIT) with a focus on sustainable real estate assets related to transportation, energy infrastructure, and controlled environment agriculture (CEA) in the United States. As of its latest filings, Power REIT owns approximately 112 miles of railroad infrastructure, 447 acres of land leased to utility-scale solar power projects, and 249 acres of land for greenhouse cultivation of food and cannabis (SEC.gov) (Stock Analysis).

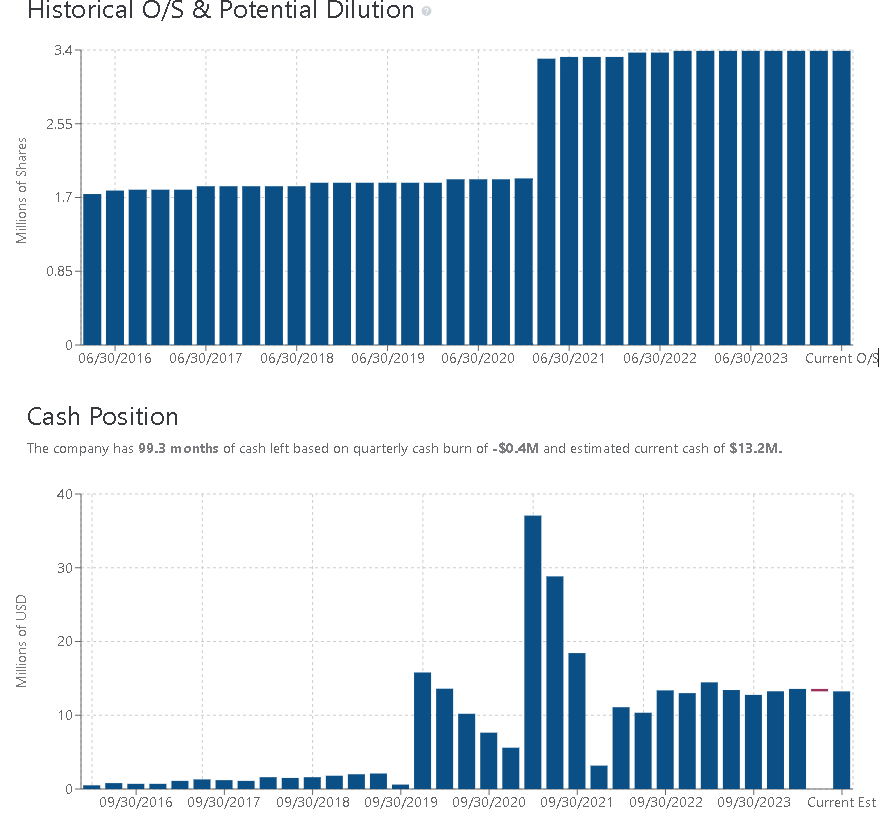

Recent Financial Performance

2023 Financial Highlights (as of December 31, 2023):

- Revenue: $4.02 million, up from $3.68 million in the previous year.

- Net Income: $0.87 million, compared to a net loss of $0.42 million in 2022.

- Cash and Cash Equivalents: $4.42 million, down from $5.31 million at the end of 2022 (Last10K) (Stock Analysis).

Key Transactions

- January 8, 2024: Sold two cannabis-related greenhouse properties in Colorado for $1.325 million, with seller financing of $1.25 million at a 10% interest rate, increasing to 15% over time.

- January 30, 2024: Sold interest in a ground lease for solar farms in Massachusetts for $1.2 million (SEC.gov).

Dividends and Preferred Stock

Power REIT has been paying regular dividends on its 7.75% Series A Cumulative Redeemable Perpetual Preferred Stock, with a quarterly dividend of approximately $163,000 ($0.484375 per share) (SEC.gov).

Future Outlook

The company is actively expanding its portfolio, particularly in the area of controlled environment agriculture, which includes greenhouse properties for food and cannabis cultivation. This aligns with its commitment to the “Triple Bottom Line” strategy, focusing on profit, planet, and people.